The use of technology is unavoidable in today’s world. We must educate ourselves on the inherent risks and exposures, take steps and seek advice on how to help prevent the loss of information and how to help protect ourselves from the financial impact of a cyber event.

The use of technology is unavoidable in today’s world. We must educate ourselves on the inherent risks and exposures, take steps and seek advice on how to help prevent the loss of information and how to help protect ourselves from the financial impact of a cyber event.

Cyber insurance has continued to evolve as legislation is broadened and cyber events have become more far reaching and numerous. Data and personal information carries far reaching ramifications especially for business owners tasked with protecting their customer’s information.

What is Cyber Insurance?

Cyber insurance covers your business’ liability for a data breach that includes sensitive customer information. This could include things like Social Security numbers, credit card numbers, account numbers, driver’s license numbers and medical records.

Cyber liability insurance is specifically designed to address the risks that come with using modern technology; risks that other types of business liability coverage simply won’t. The level of coverage your business needs is based on your individual operations and can vary depending on your range of exposure. It is important to work with an agent that can identify your areas of risk so a policy can be tailored to fit your unique situation.

Why do you need it?

Cyber Insurance is a must for any business that relies on information technology and the Internet. As organizations have become more reliant on applications, databases and the cloud, they have become more exposed to risk from mishandled or misappropriated data. While some business or malpractice insurance policies may have some coverage, it’s typically added by endorsement with a relatively low limit. The endorsement may also contain sub-limits for certain perils.

What does Cyber Insurance cover?

A cyber insurance policy is designed to cover data, privacy, and network exposures. Since cyber security is one of the fastest growing and changing risks in the world today, both cyber novices and smart & tech-savvy business owners can feel better protected with a policy that insures against data breaches, hacks, and other types of cyber security events.

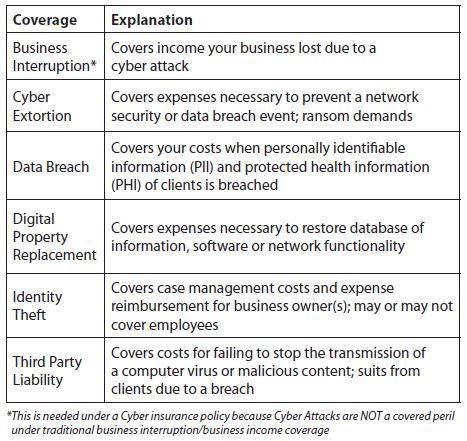

Cyber insurance has not yet been standardized by the insurance industry, so terminology between carriers can differ. There are certain coverage items to look for when considering a cyber insurance policy. Below are some of the most common ones, along with an explanation:

As reliance on technology continues to increase, new exposures continue to emerge. As your business grows, make sure your cyber liability coverage grows with it. Professional Insurance Programs is here to help you analyze your needs and make the right coverage decisions to help protect your business from unnecessary risks.