WDA Association Health Plan

The WDA Association Health Plan is exclusive to WDA members only! The WDA Association Health Plan allows practices to be underwritten outside of community rating. This means there will be health underwriting and your group will be rated accordingly, (unlike ACA plans which do not take existing conditions into consideration).

Details about the plan:

- The practice owner must be a current WDA member to set up their group plan with the WDA Association Health Plan. Membership will be verified.

- Health insurance must be offered to all eligible employees of the dental practice. Eligible employees are those who work 26 hours or more per week.

- Employer contribution is recommended, but not required.

Plan designs:

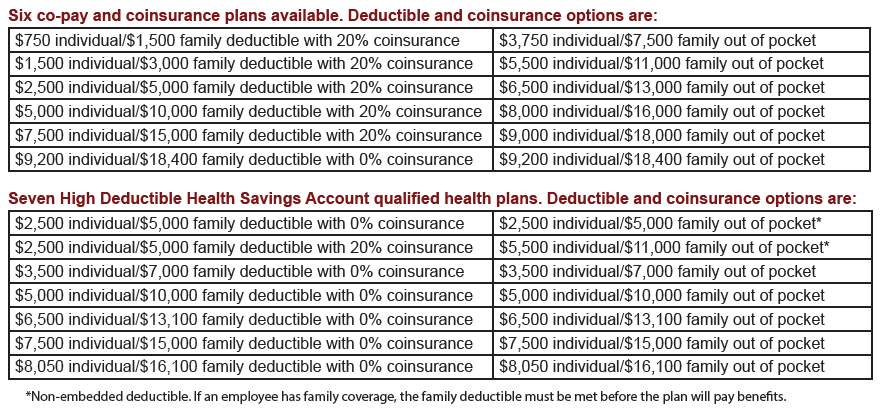

- Six co-pay and coinsurance options with deductibles starting at $750.

- Seven High Deductible Health Savings Account qualified health plans with deductibles starting at $2,500.

If this is the best option for your practice, you’ll set up your plan based on the design options below.

WPS Health Insurance used the Statewide Network, view brochure. This is the broadest, most inclusive network available in Wisconsin. View available plans.

On-Demand Webinar: A Deeper Look, Wisconsin Dental Association Group Health Plan Benefits for Dental Practices

To get started please fill out the census below and return it to our staff either by email, info@profinsprog.com, or fax, at 414-277-1124. If you have any questions, just give us a call at 1-800-637-4676.

Request Additional Information

In addition to health insurance, let our knowledgeable staff help you put an insurance package together tailored to meet your specific needs.

We have partnered with Illinois Mutual to provide an exclusive Short Term Disability and Tem Life Insurance program to Wisconsin dentists and staff. Illinois Mutual is a best in class regional carrier known for its customer service and understanding of the types of coverage today’s dental team members are looking for.

We also partnered with MGIS to offer Group Long-Term Disability (LTD) Insurance. This policy pays benefits when the insured can no longer perform the “actual procedures†they have provided from the past 12 months, as shown by their CPT/CDT/SNOMED codes. Partial or total disability.

We have teamed up with Mineral to provide FREE human resource support to our clients. Mineral offers an integrated suite of HR knowledge, compliance tools and training solutions supported by live HR experts. This service is available upon request for clients of Professional Insurance Programs. Click here for more information.

For those WDA Members looking to set up a Section 125 plan (premium-only plans or flex spending accounts), health savings accounts, health reimbursement arrangements or assistance with ERISA compliance, special WDA member pricing has been arranged through our partners.

Request Additional Information

We are excited to help you put an insurance package together, contact us at 800-637-4676 or info@profinsprog.com.

Tools & Resources:

Health Insurance FAQ in regards to COVID-19

For a glossary of health coverage and medical terms, click here.

A summary of the Affordable Care Act can be found here.

Tools & Resources:

Health Insurance FAQ in regards to COVID-19

For a glossary of health coverage and medical terms, click here.

A summary of the Affordable Care Act can be found here.